Table of Contents

Store Settings - Payment Gateway

Supported Payment Gateways

Choose the payment gateway that you will be using with this store, and enter the corresponding credentials.

- Here is a list of currently supported payment gateways.

- The credentials that you need to enter are different depending on the payment gateway that you will be using.

- Each SubscriptionBridge store can only be associated with one payment gateway at this time

- Once a store has been associated with a payment gateway, this setting cannot be changed

- If you are setting up a test store to familiarize with SubscriptionBridge, use the Test Gateway or you can use the payment gateway that you have chosen in a sandbox environment, if available. See:

Credit Card Types

You can specify the credit card types that are accepted by your store. This setting only applies to stores that are using the SubscriptionBridge shopping cart (Simple Integration).

Card Authorization Settings

Why authorize a card?

When a subscription is created, there are many cases in which a payment is not processed. For example, a gym membership with a 7-day free trial, an online gaming Web site subscription with a “First Month Free” promotion, etc.

In all of these cases, most payment gateways do not by default check the validity of the credit card used for the subscription (e.g. Authorize.Net does not validate the card in this scenario). It does so only at the time the first subscription payment is processed, which could be well into the future.

To avoid creating a subscription for a customer that is using invalid credit card information (e.g. invalid card security code), SubscriptionBridge allows you to authorize the card and stop the customer from proceeding if an authorization is not received.

Available card authorization options

Specifically, you have the following options:

- Zero Dollar Authorization (ZDA)

This enables applications like SubscriptionBridge to check the validity of a credit card account without authorizing any specific amount. This is clearly the best way to accomplish this goal. The problem is that - as of February, 2010 - not all processors are capable of handling Zero Dollar Authorizations (see this Authorize.Net article on this topic). If you check this option and SubscriptionBridge detects that a ZDA cannot be performed, it will perform a $1 authorization instead. If you already know that your processor does not support ZDAs, then do not check this option. - $1.00 Authorization

SubscriptionBridge will do an “authorize-only” transaction for $1, then void the transaction immediately after it was authorized. No charges are ever debited, and the transaction will disappear automatically from the customer's transactions record. - Full Transaction Amount

SubscriptionBridge will do an “authorize-only” transaction for the amount of the subscription, then void the transaction immediately after it was authorized. No charges are ever debited, and the transaction will disappear automatically from the customer's transactions record. The amount authorized, however, is “reserved” until it is removed from the account. If the amount is large, this could theoretically create a problem for the customer as it reduces the available credit.

Other notes on this feature:

- The reason why you can choose both a $1 authorization and a ZDA (Zero Dollar Authorization) is that if you know that your processor does not support ZDAs, it does not make sense to have SubscriptionBridge attempt a $0 authorization every time and then fail back onto a $1 authorization. In that scenario, it makes more sense to select $1 authorizations from the start.

- PayPal Website Payments Pro and Authorize.net are handled the same way with regard to this feature.

- This feature is not supported by PayPal Express Checkout.

Which one to choose

Even if there is no free trial, the first transaction is typically processed several hours after the subscription has been setup. When using Authorize.Net, for instance, subscription payments are processed by the Authorize.Net Automated Recurring Billing system during the night (around 2 AM PST).

This can create an issue if:

- You are providing a service that can be immediately “consumed” after the subscription has been setup (e.g. downloading digital content)

- You are concerned with the possibility that the customer's card can “pay” for the product/service

In this scenario a ZDA or $1 authorization does not help in that the card might authorize for $1, but not for the full subscription amount (e.g. that amount may be over the customer's credit limit). This is a scenario in which it might make sense to authorize the full subscription amount.

In all other cases (the product/service cannot be immediately obtained, and/or the subscription amount is low), a Zero Dollar Authorization (if supported by your processor) or $1 Authorization should provide sufficient protection.

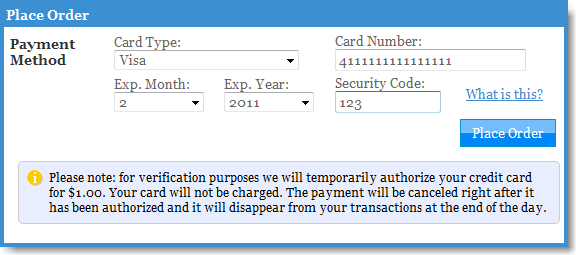

Letting customers know

Among the “Store Messages” there is one named “Card Authorization Notification”. This message is shown on the payment page in order to let customers know that their credit card will be authorized for the transaction. For example, on the right is a screen shot of how the message appears on the SubscriptionBridge Shopping Cart. If you are using an integrated shopping cart, the message should be displayed on the payment page as well.

The default message is rather generic. You can tweak the message so that it matches your authorization settings.

For example, if you setup your store to do a Full Transaction Amount authorization, you should notify customers so that they know what happened when they see the transaction on their credit card statement (e.g. through online banking). Remember: even if the transaction is immediately voided, the authorization will appear on the customer's statement for a few days.

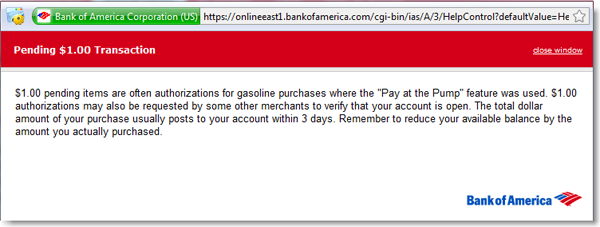

Online banking and $1 authorizations

Many banks automatically recognize $1 authorizations as temporary transactions that are going to automatically disappear from a customer's account. The transaction does appear in the customer's online banking transactions report, and it does temporarily reduce the available credit (or checking account balance in the case of a check card), but information is provided to customers indicating that the transaction will likely disappear.

For example, here is the information provided by a major bank such as Bank of America (this is current as of March, 2010):